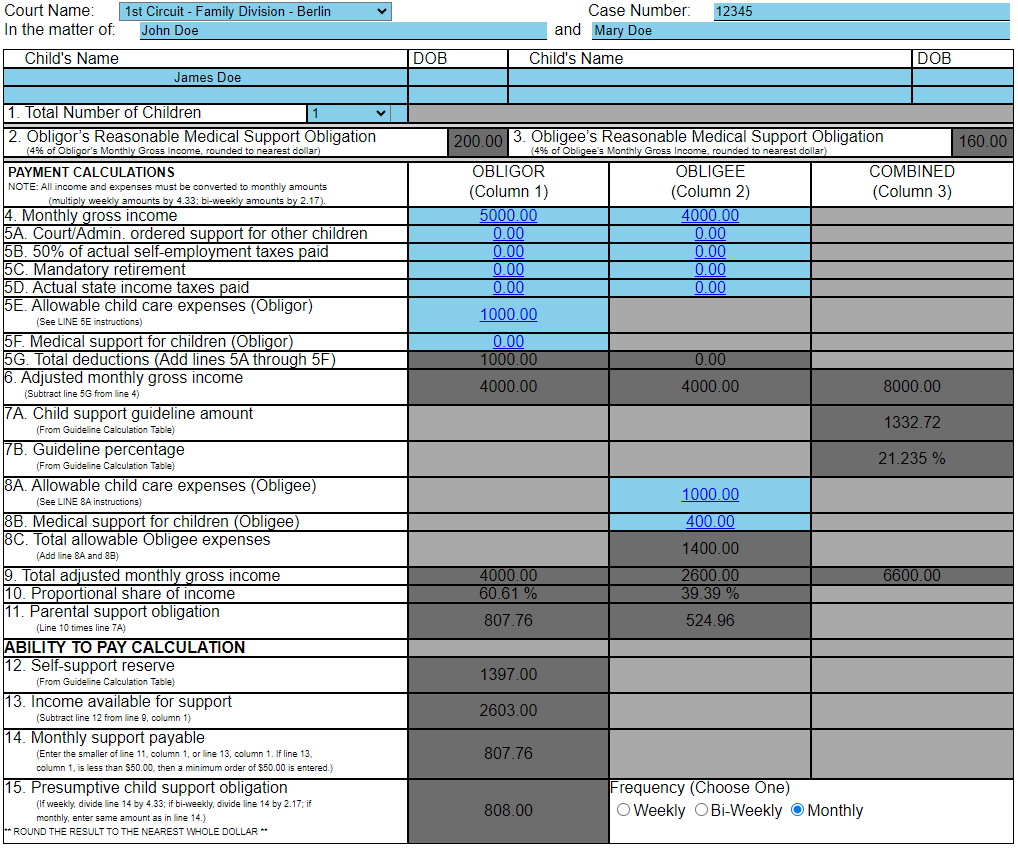

The Child Support Guidelines Worksheet

To the right you’ll find the important sections of the Child Support Guidelines Worksheet. When making the calculations you should use the State’s calculator located here “New Hampshire Child Support Calculator .” While the calculator can be somewhat difficult to use, here are a few things to remember.

- When you enter values always enter numbers with two (2) decimal places or it will generate an error. So entering “100” or “100.0” will return an error “Please supply a valid dollar amount.” You must enter numbers in a format like “100.00” in every field.

- Don’t forget to select the proper number of children in the drop-down menu at the top. It’s easy to overlook.

- When you enter a value click on “Ok” in the popup window. If you just hit enter it will not save the value (even though the popup will close).

- When you have completed the form select “Print/Save” at the top. This will allow you to either print the page or save it to a PDF. This can be submitted to the court as it will print in the correct format.

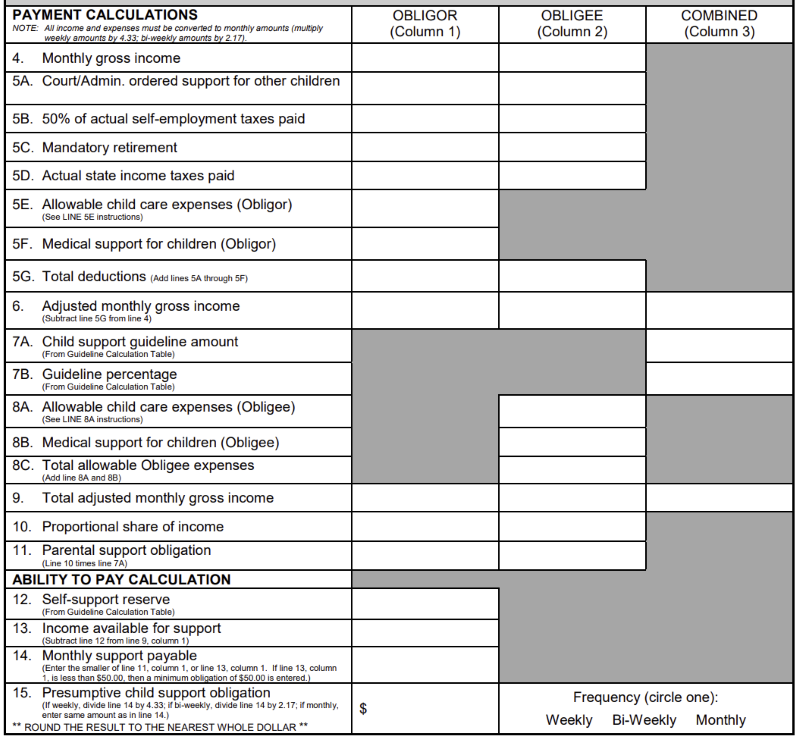

It’s crucial that you grasp the specific requirements of each field on the Worksheet. While the official definitions can be found in New Hampshire RSA 458-C:2, we’ll offer simplified explanations here. Keep in mind that every case is unique, so you should consult RSA 458-C to see if any of the numerous exceptions might apply to your situation.

Frequency (Bottom Right Corner)

The frequency selected on the calculator or paper form determines the timeframe for applying the child support worksheet. The online calculator typically defaults to a monthly frequency. However, in specific situations, choosing weekly or biweekly might be more advantageous. It’s important to note that these selections do not alter how child support is calculated; they simply indicate the payment frequency.

4. Monthly gross income

“Gross income” includes all earnings from any source, whether you work for them or not. This encompasses wages, salary, commissions, tips, annuities, social security, trust income, lottery winnings, interest, dividends, rental income, self-employment earnings, alimony, business profits, pensions, bonuses, and government payments. Occasional overtime for hourly workers, beyond 40 hours a week, is not included. If you receive a paycheck, this is the amount before any taxes or other deductions are removed.

5A. Court/Admin. ordered support for other children

The amount of child support you are paying for other children that are unrelated to your present case.

5B. 50% of actual self-employment taxes paid

This is self explanatory. Half of the self-employment taxes that you typically pay.

5C. Mandatory retirement

Many people misunderstand this section. It does not include retirement like a 401k where you can choose the amount that is deducted every pay period. This only includes retirement that is required to be deducted. Typically this is something like a pension plan.

5D. Actual state income taxes paid

Many people live and work in New Hampshire so this section does not apply. This applies to people who work in a state that has an income tax.

5E and 8A. Allowable child care expenses (Obligee and Obligor)

The child care expenses in this section only include work-related expenses. For example, day care that is required for you to attend work during your parenting time. It does not include any expenses that are not directly related to caring for your child so that you can work.

5F and 8B. Medical support for children (Obligee and Obligor)

This is the amount paid by either the Obligee or Obligor for the child’s or children’s health insurance. If the children are covered under a family plan, please calculate the difference in cost between the family plan and an individual plan. For example, if the family plan costs $1,000 per month and an individual plan costs $400 per month, enter $600 in this field on the calculator.

As a reminder, you can find the State of New Hampshire online child support calculator here.

All of the light blue boxes accept input and can be modified. All of the boxes in dark gray cannot be edited and are used by the calculator to make the final calculation.

In this example, both the Obligor and Obligee have $1,000 in childcare expenses that are required for them to continue working. The Obligee is responsible for the child’s health insurance. Neither party has child support obligations for other children, self-employment tax, mandatory retirement, or state income taxes.